Financial Modeling & FP&A

Financial Modeling & FP&A

Transform your financial data into strategic assets with our Financial Modeling & FP&A Services. We specialize in creating customized financial models that provide clarity and actionable insights, empowering your business to make informed decisions and drive sustainable growth. Our comprehensive FP&A solutions are tailored to meet the unique needs of your organization, ensuring efficiency and precision in financial planning and analysis.

Our Services

Financial Model Review

Already have a financial model?

Our team will review, stress-test, and enhance it to ensure accuracy, reliability, and alignment with your objectives.

Build a Financial Model

We create dynamic financial models tailored to your business. From forecasting cash flows and revenue to scenario planning and valuation models, we provide frameworks that support your strategic goals and investment decisions.

Build a Financial Model

We create dynamic financial models tailored to your business. From forecasting cash flows and revenue to scenario planning and valuation models, we provide frameworks that support your strategic goals and investment decisions.

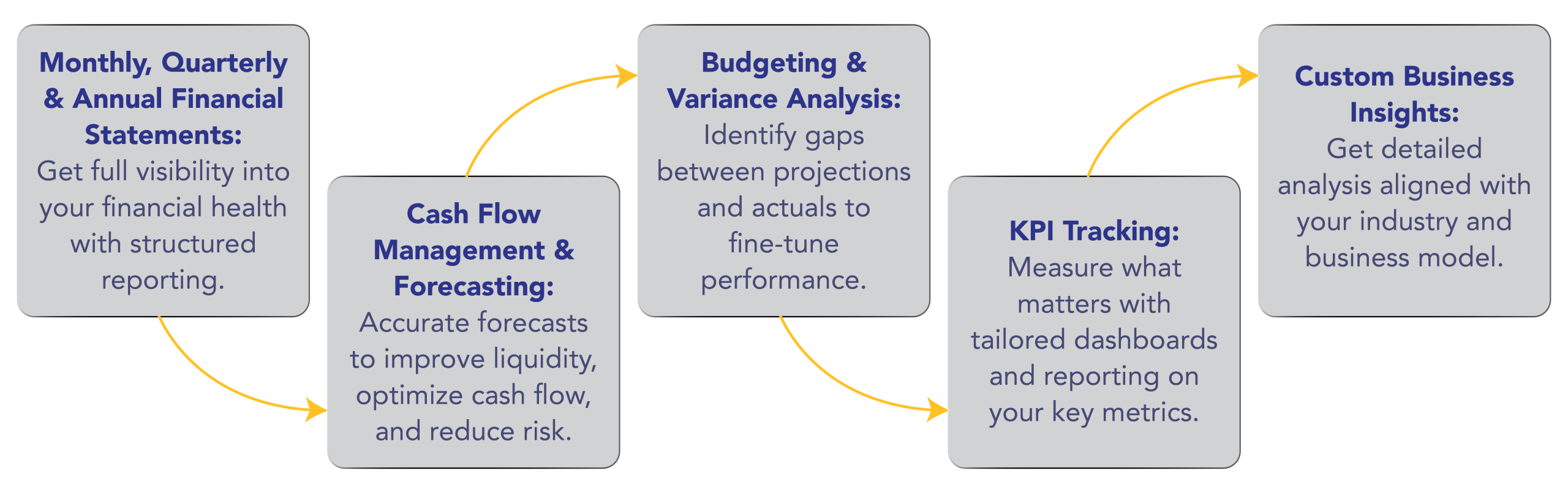

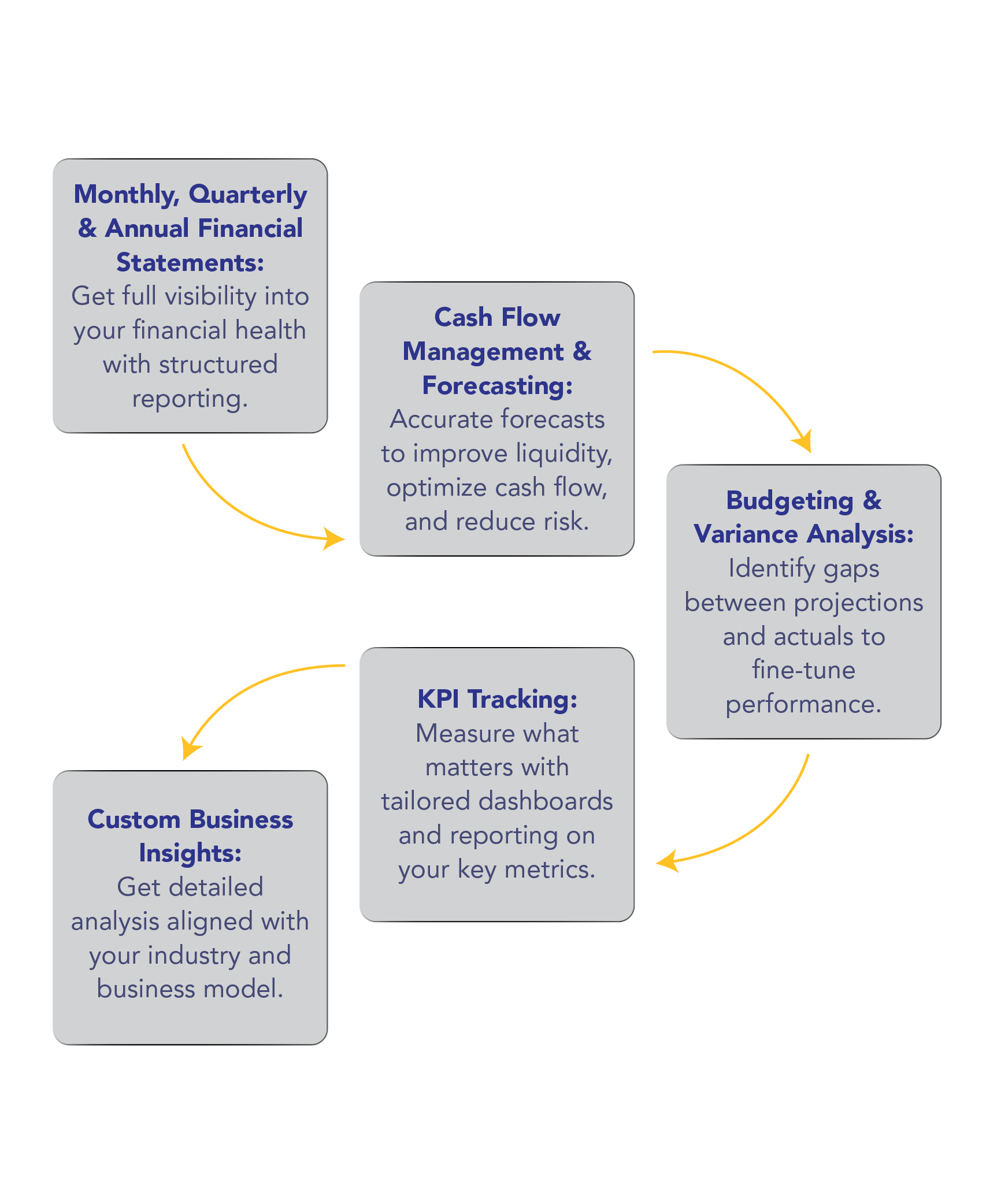

Comprehensive Financial Analysis & Reporting

Cash Flow Management & Forecasting

Accurate forecasts to improve liquidity, optimize cash flow, and reduce risk.

Monthly, Quarterly & Annual Financial Statements

Get full visibility into your financial health with structured reporting.

Custom Business Insights

Get detailed analysis aligned with your industry and business model.

KPI Tracking

Measure what matters with tailored dashboards and reporting on your key metrics.

Budgeting & Variance Analysis

Identify gaps between projections and actuals to fine-tune performance.

Inside Our Financial Planning & Analysis Offering

Comprehensive Financial Analysis & Reporting

Why Choose Our Financial Modeling & FP&A Services?

Identify cost-saving opportunities and revenue drivers.

Make informed decisions with real-time data and forward-looking models.

Ongoing collaboration to ensure your financial models evolve as your business scales.

Deliver professional-grade reports and financial projections for lenders and investors.

Why Choose Our Pilot Program?

At ExpressWorks, we understand that switching to a new financial services provider is a major decision. That’s why we offer a three-month pilot program to give you a clear view of our capabilities while aligning with your unique business goals.

No-Risk Trial

Engage with our services for three months without any long-term obligation, giving you the freedom to evaluate our performance before making a commitment.

Quick Impact

Within the first month, you’ll start noticing measurable improvements in financial clarity, decision-making efficiency, and operational transparency.

Tailored Experience

We actively gather your input throughout the pilot and adapt our services to ensure they are personalized to your specific challenges and objectives.

Built on Trust

Our consistent delivery during the pilot phase builds a strong foundation of confidence, setting the stage for a long-term, reliable partnership.

What to Expect from the Pilot

Confidence in our dedication and capability to help you meet your long-term goals

Improved financial visibility to support smarter, data-driven decisions

A clear view of how seamlessly ExpressWorks fits into your business processes

Many of our clients begin with this pilot, and after experiencing its value, choose to continue the partnership. This phase is designed as a two-way evaluation—ensuring that our collaboration is productive, purposeful, and aligned with your vision.

How We Work

Free consultation to assess your needs

Customized onboarding and transition plan

Dedicated offshore team assigned and fully integrated into your workflow

Continuous optimization and reporting for long-term success